The 15-Second Trick For Non Profit

Wiki Article

The 7-Second Trick For Non Profit Organizations Near Me

Table of ContentsEverything about 501 CEverything about Google For NonprofitsA Biased View of Non Profit Organizations Near Me7 Easy Facts About Non Profit Organizations Near Me ExplainedNot For Profit - Truths501 C Things To Know Before You BuyGetting The Non Profit To WorkNot known Facts About Nonprofits Near Me

Unlike lots of other types of giving away (through a phone telephone call, mail, or at a fundraiser occasion), donation web pages are highly shareable. This makes them ideal for boosting your reach, and as a result the number of contributions. Contribution pages enable you to accumulate and track data that can notify your fundraising approach (e.Not For Profit Organisation Can Be Fun For Anyone

donation size, when the donation was contribution, who donatedThat how muchJust how how they just how to your website, etc) Finally, ultimately pages make it convenient and simple and also easy donors to give!You can also consider running an e-mail project with routine e-newsletters that allow your readers learn about the great job you're doing. Be certain to gather e-mail addresses and various other relevant data in a correct method from the start. 8. 5 Take care of your individuals If you have not tackled working with and onboarding yet, no concerns; currently is the time - google for nonprofits.

Getting The Non Profit Org To Work

Determining on a financing version is vital when starting a not-for-profit. It depends on the nature of the nonprofit.To get more information, check out our article that talks more comprehensive concerning the main not-for-profit funding sources. 9. 7 Crowdfunding Crowdfunding has actually become one of the crucial means to fundraise in 2021. Therefore, nonprofit crowdfunding is ordering the eyeballs these days. It can be made use of for certain programs within the organization or a basic donation to the reason.

During this action, you could desire to believe regarding milestones that will certainly show a possibility to scale your not-for-profit. Once you have actually operated for a little bit, it's crucial to take some time to think regarding concrete development objectives.

The smart Trick of Irs Nonprofit Search That Nobody is Talking About

Without them, it will be tough to examine and track progression in the future as you will certainly have nothing to gauge your results versus and you will not know what 'effective' is to your nonprofit. Resources on Beginning a Nonprofit in various states in the United States: Starting a Not-for-profit FAQs 1. Just how much does it cost to begin a not-for-profit organization? You can begin a not-for-profit organization with a financial investment of $750 at a bare minimum and it can go as high as $2000.The length of time does it take to set up a not-for-profit? Depending on the state that you remain in, having Articles of Consolidation accepted by the state government might occupy to a few weeks. Once that's done, you'll need to make an application click for info for acknowledgment of its 501(c)( 3) status by the Internal Earnings Solution.

With the 1023-EZ kind, the handling time is commonly 2-3 weeks. Can you be an LLC as well as a not-for-profit? LLC can exist as a nonprofit restricted obligation company, nonetheless, it ought to be totally possessed by a single tax-exempt nonprofit organization.

Non Profit Organizations List Fundamentals Explained

What is the difference in between a foundation as well as a not-for-profit? Foundations are generally moneyed by a household or a company entity, but nonprofits are moneyed through their profits and fundraising. Structures normally take the cash they started out with, invest it, and afterwards distribute the cash made from those financial investments.Whereas, the additional money a nonprofit makes are utilized as running prices to fund the organization's objective. Is it difficult to begin a not-for-profit company?

There are a number of actions to start a nonprofit, the obstacles to entry are relatively few. 7. Do nonprofits pay taxes? Nonprofits are exempt from government revenue tax obligations under area 501(C) of the IRS. Nevertheless, there are specific situations where they may require to pay. If your nonprofit earns any type of revenue from unassociated activities, it will certainly owe earnings taxes on that quantity.

Nonprofits Near Me - An Overview

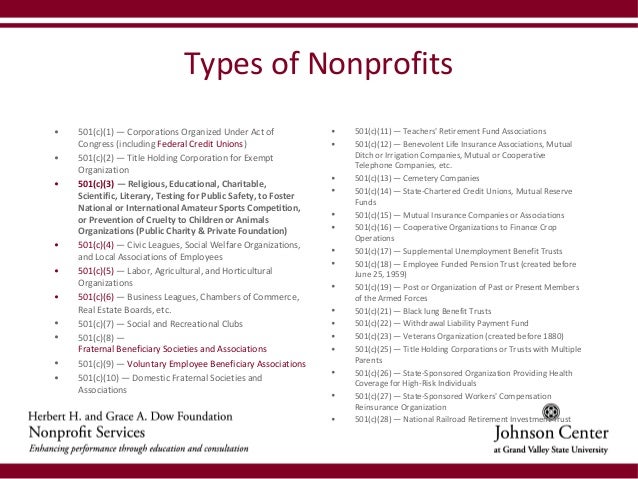

The duty of a not-for-profit company has always been to create social change and lead the way to a far better globe., we prioritize services that help our nonprofits increase their contributions.Twenty-eight various kinds of not-for-profit organizations are identified by the tax obligation legislation. By much the most usual type of nonprofits are Section 501(c)( 3) companies; (Area 501(c)( 3) is the part of the tax obligation code that licenses such nonprofits). These are nonprofits whose mission is philanthropic, religious, instructional, or clinical. read here Section 501(c)( 3) company have one big benefit over all other nonprofits: contributions made to them are tax obligation deductible by the contributor.

This classification is important since private structures undergo stringent operating guidelines and also guidelines that do not put on public charities. For instance, deductibility of payments to a personal structure is more limited than for a public charity, and also exclusive structures are subject to excise taxes that are not imposed on public charities.

4 Easy Facts About Google For Nonprofits Described

The bottom line is that private structures obtain much even worse tax obligation therapy than public charities. The primary difference between personal structures as well as public charities is where they get their financial backing. A private structure is generally controlled by an individual, family, or corporation, and also gets many of its earnings from a few donors and also investments-- an example is the Expense and also Melinda Gates Structure.This is why the tax regulation is so hard on them. Most structures simply provide cash to other nonprofits. Nevertheless, somecalled "running foundations"run their very own programs. As a sensible matter, you require at the very least $1 million to start an exclusive foundation; otherwise, it's unworthy the trouble as well as expenditure. It's not unexpected, after that, that an exclusive foundation has actually been called a big body of cash surrounded by people who want several of it.

An Unbiased View of Non Profit Organizations Near Me

If the IRS categorizes the nonprofit as a public charity, it keeps this condition for its very first five years, despite the general public assistance it actually gets during this time around. Beginning with the nonprofit's 6th tax obligation year, it needs to show that it meets the general public assistance test, which is based on the assistance it obtains throughout the present year and previous 4 years.If a not-for-profit passes the examination, the IRS will certainly continue to check its public charity condition after the first 5 years by requiring that a finished Arrange A be filed yearly. Find out even more about your not-for-profit's tax standing with Nolo's book, Every Nonprofit's Tax obligation Guide.

Report this wiki page